The Rise of “Shadow IT”: How Unsanctioned Apps Are Putting Your Business at Risk

October 16, 2025

Your Cyber Insurance Claim Was Just Denied: The 3 Reasons Why That Happens

October 18, 2025For many small to medium-sized business (SMB) owners in Houston, data compliance sounds like a term reserved for massive corporations with dedicated legal departments. You may hear acronyms like GDPR or HIPAA and think, “That doesn’t apply to me.” Unfortunately, that assumption could be your biggest legal and financial liability.

In today’s interconnected digital world, regulatory compliance is no longer optional—it’s a mandatory cost of doing business. Whether you handle credit card information, customer health data, or even just collect email addresses, rules apply. Non-compliance doesn’t just mean a slap on the wrist; it means fines that can permanently shutter your SMB.

The good news is that you don’t have to navigate this complex legal landscape alone. Your Managed Service Provider (MSP), Krypto IT, is your most valuable partner in achieving and maintaining compliance.

The Compliance Landscape: More Than Just Two Acronyms

While there are hundreds of regulations globally, SMBs primarily need to understand the ones that touch their data, customers, and payment methods.

1. HIPAA (Health Insurance Portability and Accountability Act)

- Who it affects: Any business that deals with protected health information (PHI), including doctors’ offices, clinics, and any vendors (like billing or software providers) who handle PHI on their behalf.

- The risk: Fines for willful neglect can reach hundreds of thousands of dollars, and the required data breach reporting can destroy trust.

- The compliance focus: Strict technical controls on how PHI is accessed, stored, transmitted, and deleted.

2. PCI DSS (Payment Card Industry Data Security Standard)

- Who it affects: Virtually any business that accepts credit card payments, regardless of size.

- The risk: If your system is breached and customer card data is stolen, you face significant fines from credit card companies, mandatory forensic audits, and potential loss of the ability to process cards.

- The compliance focus: Securing the “cardholder data environment,” which involves network segmentation, strong encryption, and regular vulnerability scanning.

3. GDPR (General Data Protection Regulation)

- Who it affects: Any business, anywhere in the world, that processes the personal data of European Union (EU) residents. If you sell a product online to someone in Germany, GDPR applies.

- The risk: Fines can be colossal, reaching up to €20 million or 4% of a company’s global annual revenue, whichever is higher.

- The compliance focus: Explicit user consent, the “Right to Be Forgotten,” and mandatory breach notification within 72 hours.

4. State-Specific Regulations (CCPA/CPRA, etc.)

Many US states, led by California (CCPA/CPRA), have adopted their own rigorous consumer data protection acts. If you have customers or clients in these states, their rules may apply to you, demanding transparency about how you collect and use their data.

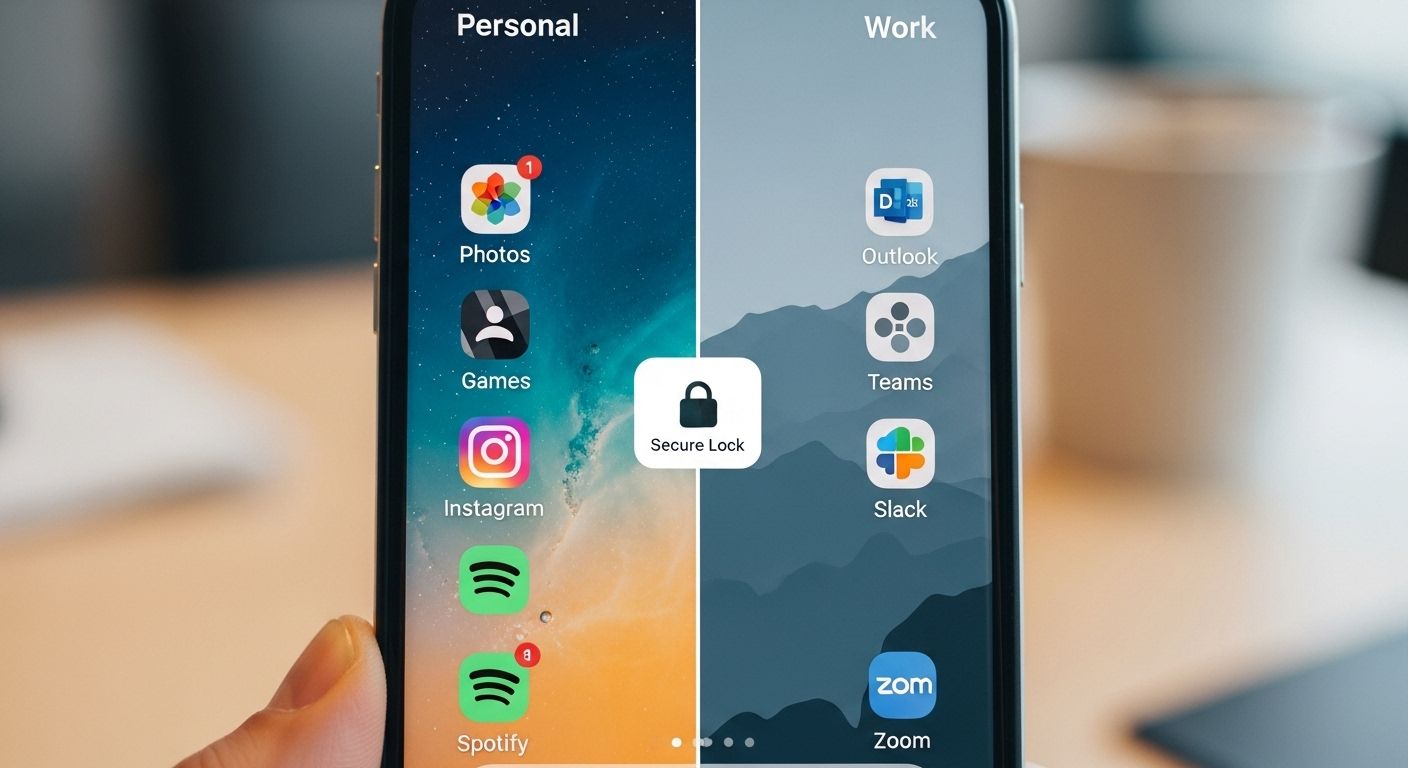

Why Compliance Is a Cybersecurity Problem (Not Just a Legal One)

Compliance frameworks are essentially checklists for good security hygiene. They mandate the use of technical controls like:

- Multi-Factor Authentication (MFA): Required by most modern standards to prevent unauthorized access.

- Encryption: Mandated to protect data at rest and in transit (e.g., sending health records or credit card numbers).

- Access Control: Ensuring only necessary personnel can access sensitive systems and data.

- Audit Trails: Logging all activity to prove compliance and detect breaches quickly.

The penalties for a compliance failure are almost always triggered by a security failure (i.e., a data breach). By focusing on strong cybersecurity, you are simultaneously achieving compliance.

Your MSP: The Compliance Simplifier

As an SMB, you don’t have the time or resources to hire a full compliance officer, but you need that level of expertise. This is the superpower of partnering with Krypto IT. We don’t just fix broken computers; we integrate compliance into your entire IT infrastructure:

- Auditing and Gap Analysis: We assess your current systems against relevant regulations to identify where you fall short (the “gaps”).

- Implementation of Technical Controls: We deploy the mandatory technical measures, such as advanced Endpoint Detection and Response (EDR), file encryption, secure cloud solutions, and firewalls configured for network segmentation (crucial for PCI DSS).

- Policy and Documentation Support: We help create the required documentation, incident response plans, and user training materials to prove due diligence.

- Continuous Monitoring: Compliance is not a one-time event. We provide 24/7 monitoring and vulnerability scanning to ensure your systems remain compliant even as regulations or your business evolves.

Don’t let the fear of acronyms paralyze your business. Krypto IT makes compliance manageable, turning a complex legal obligation into a streamlined, automated part of your IT security posture.

Ready to turn compliance confusion into a competitive advantage? Contact Krypto IT today for a compliance readiness assessment.